Identifying fraud

Preventing fraud starts with identifying these common signs.

With new scams appearing every year, fraud prevention becomes more and more important in our daily lives. With just a few steps, you can prevent fraud from happening to you. The first step is knowing how to identify fraud when you see it. Here are some of the most common signs that a message is coming from a scammer.

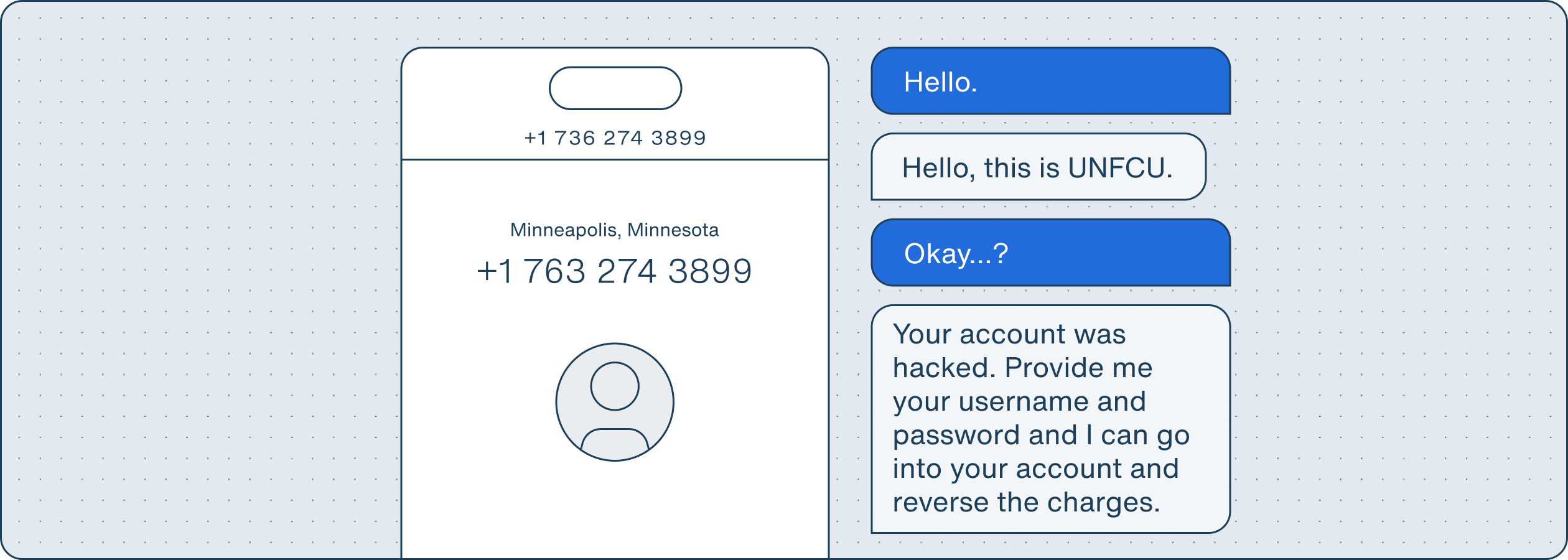

1. Phone calls

One of the most common ways a scammer attempts to reach you is by phone. Look for these signs if you receive a suspicious call:

- Unfamiliar caller ID: If you receive a call from a phone number you do not know, or the caller ID comes from a country you have no affiliation with, it is most likely a scam. Remember — scammers may have access to technology that displays their call as coming from UNFCU. A scam call may still appear as UNFCU on caller ID.

- Unexpected calls: Be cautious of calls you are not expecting. Scam calls often occur randomly, with no association with a recent action you may have taken.

- Asks for personal info: Never disclose sensitive information. Legitimate organizations and institutions will never ask you for personal details, like your password.

- Request for remote access: If the caller asks for remote access to your computer — hang up immediately. Financial institutions, like UNFCU, will never ask for access to your devices.

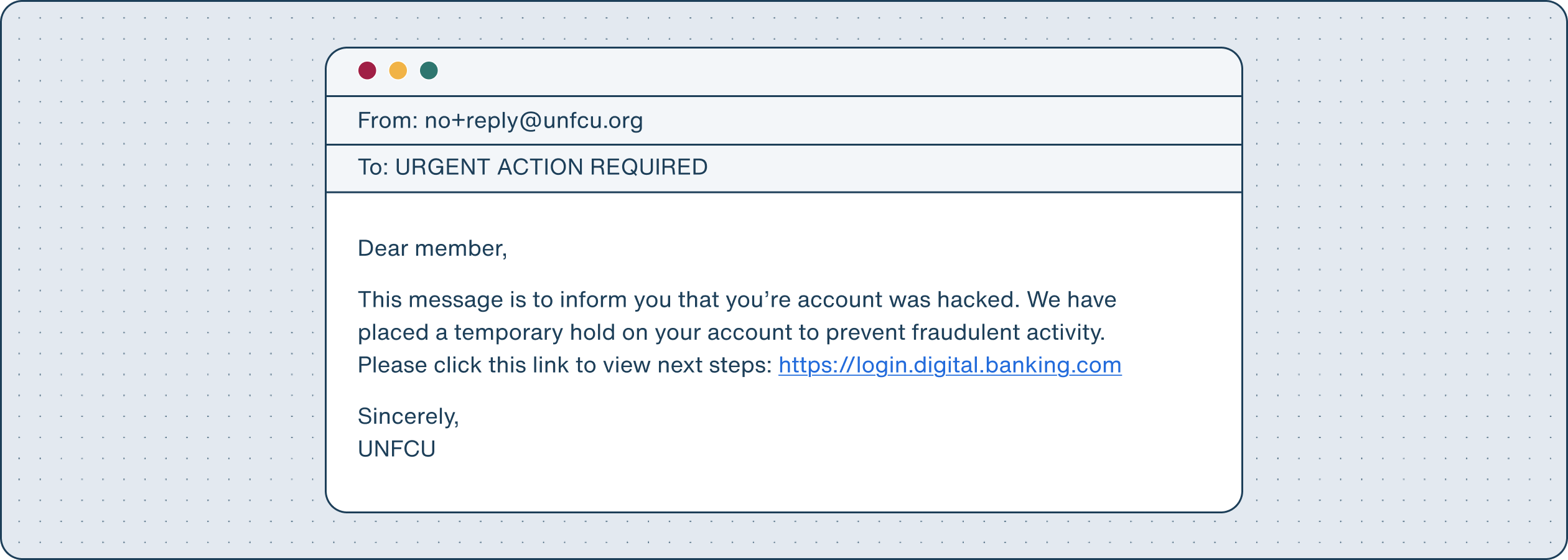

2. Emails

Emails are a popular resource for scammers. Commonly known as phishing emails, many look like they are coming from a trusted source. Here are some common red flags that may indicate an email is fraudulent:

- Incorrect domain names: If you receive a suspicious email, double check that the domain name matches the company’s official email address listed on their website.

- Misspellings & poor grammar: Official senders will rarely send an email with spelling or grammatical mistakes.

- Unsolicited requests: An email with an unexpected request for you to take action is likely fraudulent.

- Unexpected content: Never click on links or attachments you were not expecting to receive.

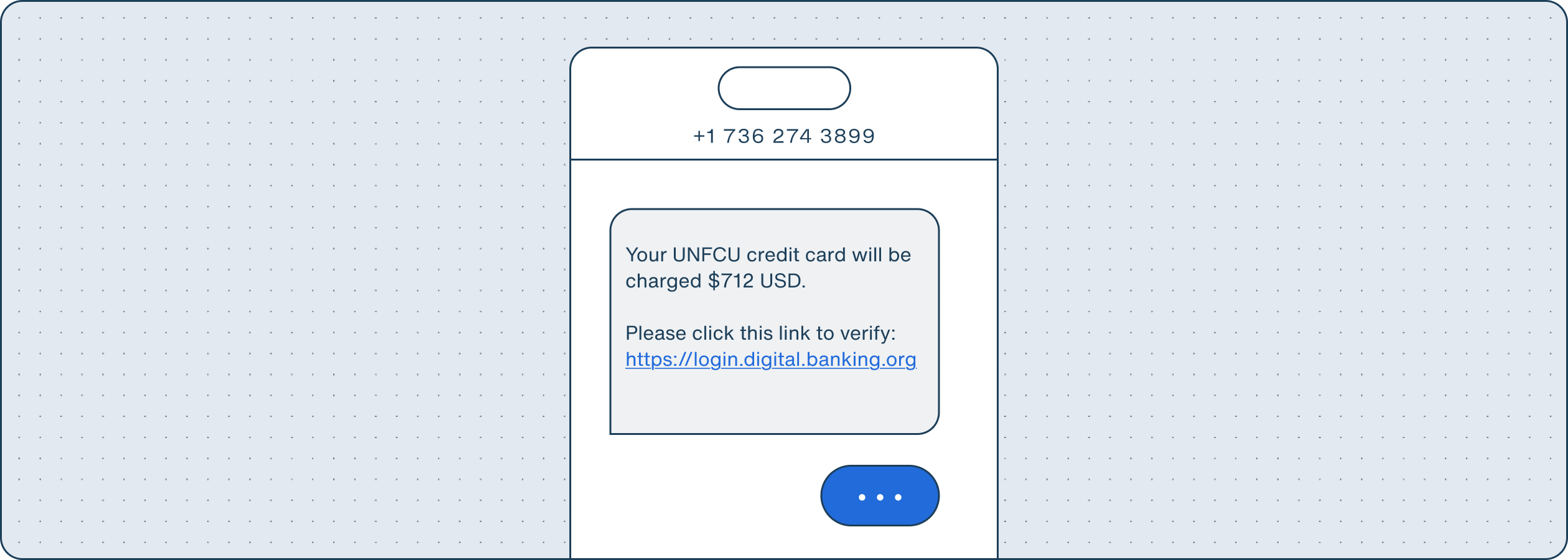

3. Text messages

Scam text messages come in many different forms. Sometimes, they can look like they’re coming from a friend. Other times, they can look like they're coming from your financial institution. Look for these signs if you are suspicious of a text:

- Unfamiliar numbers: If the phone number is not in your contacts, or you don’t recognize the area code, it is best not to respond.

- Extraordinary offers: If an offer is too good to be true, it likely is. It’s better to ignore the offer than to respond.

- Suspicious links: Legitimate institutions will rarely send you unsolicited links to click in a text message.

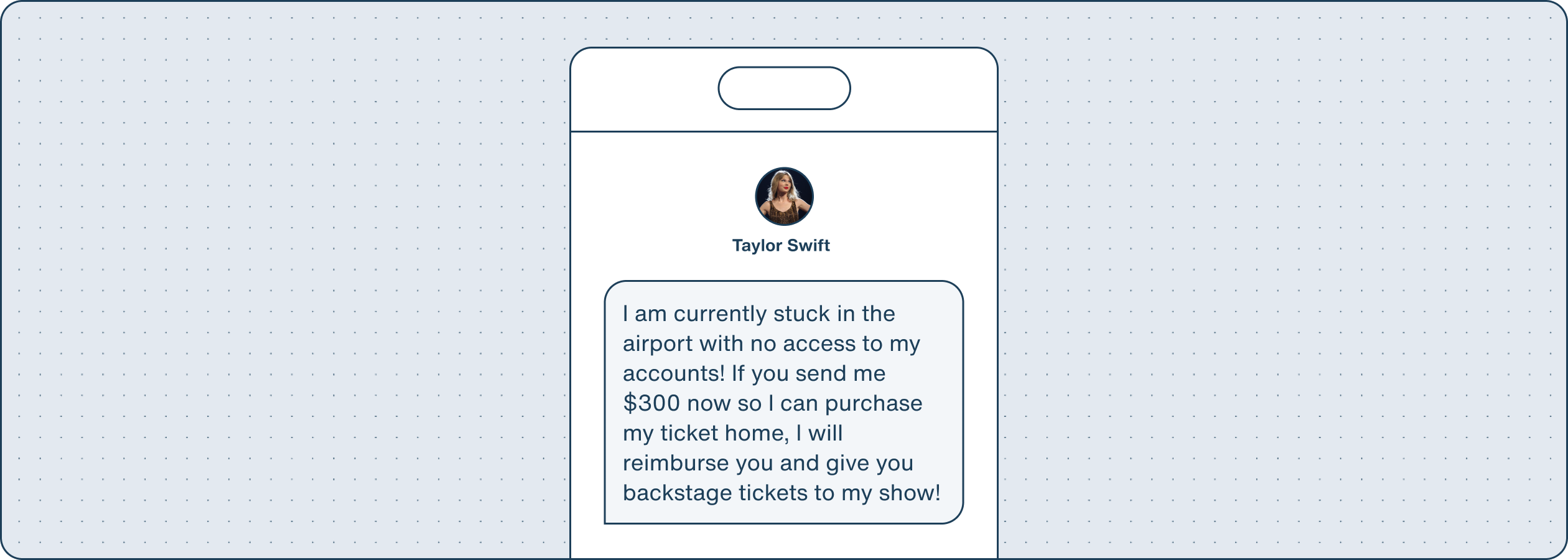

4. Social media

It is always important to take security precautions when you’re active on social media. Many scammers create fake profiles to lure users into fraud schemes.

- Money requests: Never send money to someone you have never met or only know online.

- Outlandish scenarios: If you receive a message that details an odd or unlikely situation, it is almost always a scam.

Further reading

After identifying fraud, know what to do next. We compiled a list of common fraud schemes and how to protect yourself from them.

You may also be interested in

Protect yourself from fraudsters & scammers

Zelle®: Send money safely